Understanding Monthly Mortgage Costs in 2025

Buying a home in 2025 is still one of the biggest financial steps most Americans will ever take. And with mortgage rates and home prices staying high, many people are now spending more on their monthly mortgage than on almost anything else. Understanding what affects the average monthly payment can help you plan better and know what to expect.

What affects your monthly mortgage payment?

Your monthly payment depends on a few key things:

- How long your loan lasts. A 30-year loan spreads payments out more, so you pay less each month. A 15-year loan costs more per month but saves money in the long run.

- How expensive the home is. Higher home prices mean bigger loans and bigger payments.

- Your down payment. The more you put down at the start, the less you borrow and the lower your monthly bill becomes.

- Your interest rate. This is a big one. Higher rates make monthly payments jump, while adjustable-rate mortgages can start low but change later.

All of these come together to shape what homeowners pay every month.

Average mortgage payments in 2025

In 2025, the average monthly mortgage payment in the U.S. is usually between $2,100 and $2,300 for a standard 30-year fixed loan. This is much higher than just a few years ago. Home prices have stayed high, and interest rates haven’t dropped as quickly as buyers hoped, so the monthly cost of owning a home has climbed.

Why payments are higher now

There are a few reasons monthly payments have gone up:

- Homes today often cost more than they did even a couple of years ago.

- Interest rates are still higher than the very low rates we saw earlier in the decade.

- Many people are buying with smaller down payments, which means borrowing more and paying more each month.

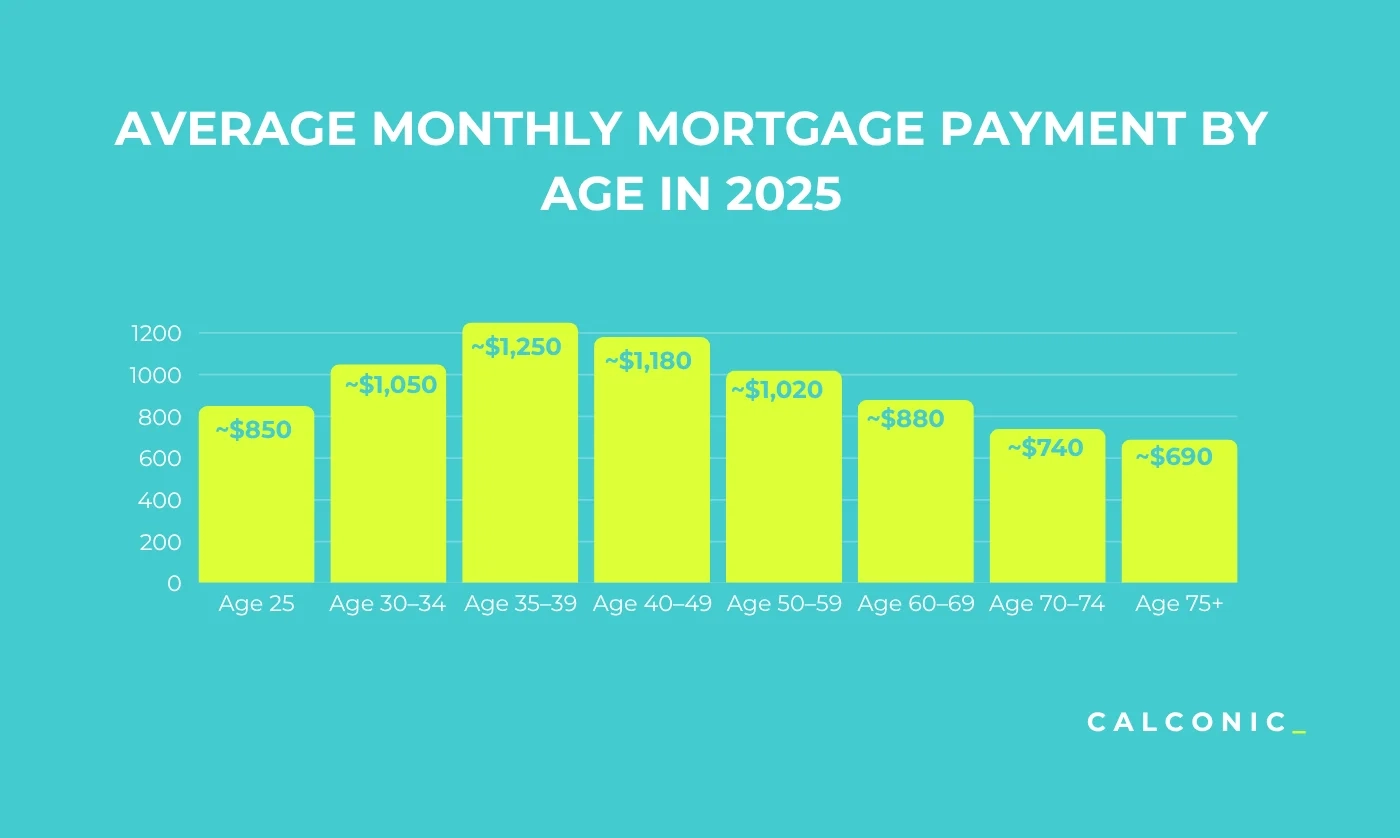

How payments change by age

Mortgage payments tend to follow a predictable pattern as people get older:

- People in their mid-20s usually have the lowest mortgage payments, mostly because many haven’t bought a home yet.

- Payments peak around ages 35–39, when many Americans buy larger homes or take on their biggest mortgages.

- By age 75 and older, payments drop a lot because most people have paid off their homes or downsized.

So, your age and stage of life can play a big role in what you pay each month.

Average Monthly Mortgage Payment by Age in 2025

In the image below, you can see how the average monthly mortgage payment varies across different age groups in 2025, highlighting the shift in financial responsibilities as homeowners move through different life stages.

What this means for homebuyers in 2025

If you’re thinking about buying a home this year, it’s worth planning carefully. Saving a larger down payment, choosing the right loan type, and looking at areas with more affordable prices can make a big difference. And even though average payments are higher, taking time to budget and compare options can help you find something that fits your life comfortably.